Inflation Over, Sticker Shock Isn’t

Feb. 11, 2024

Bacon, eggs and toast for breakfast. Meat loaf and potatoes for dinner. Ice cream and chocolate-chip cookies for dessert.

The sticker shock that hits you while filling the grocery cart is real. The cost of these items, along with the rest of Our Common Purpose’s hypothetical weekly shopping list for a household of four, has jumped 28% since 2020.

And that’s best case. It assumes someone in the household is willing and able to prepare those meals every day. The Consumer Price Index doesn’t track most of the processed, and presumably more expensive, foods that have become a greater part of the national diet. Additionally, by the way, it also doesn’t track staples such as peanut butter and jelly nor most vegetables other than romaine lettuce and tomatoes.

That makes for something of an imperfect exercise in gauging the increase in food costs for a household of four, but it’s reassuring that this computation of 28% is snug up against the Washington Post’s independent calculation of 28.5%. In any event, the exercise shines light with whatever precision on what we’re all experiencing.

We know about eggs, which even though the price has come down, still cost $2.50 a dozen today versus $1.48 in 2020. A loaf of white bread has jumped from $1.53 in 2020 to $2.02 today. A bag of chocolate chip cookies has risen from $3.79 to $5.12. Ground beef is up from $3.95 per pound to $5.21. A 12-ounce can of orange juice concentrate has gone from $2.33 to $3.71. A pound of sugar is up from 67 cents to 96 cents. A can of soda has risen from 39 cents to 57 cents.

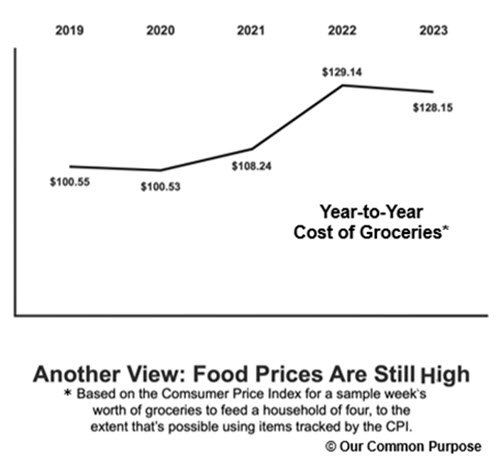

Overall, Our Common Purpose’s analysis of the Consumer Price Index data shows that grocery prices jumped 7.7% in 2021 and another 19.3% in 2022, before actually dropping 0.8% in 2023.

Overall, Our Common Purpose’s analysis of the Consumer Price Index data shows that grocery prices jumped 7.7% in 2021 and another 19.3% in 2022, before actually dropping 0.8% in 2023.

With that leveling off, the Fed is claiming and prominent media pundits are crowing that inflation has been tamed. But while the Biden administration is doing its best to downplay inflation and more generally the overall economy as being valid issues in the upcoming election, issues they remain.

The economy registered more concern than any other issue in Our Common Purpose’s public opinion survey of the battleground states conducted in December, with 89% of voters calling it either critical or very important. And when respondents were given an open-ended opportunity to say what issues were on their mind, they mentioned inflation more frequently than anything else.

Biden’s problem being that while inflation has cooled, the higher prices it caused have not gone away. A cart of groceries that cost $100 to purchase in 2019 and 2020 costs $128 today. It’s the same data but looked at in different ways. One view shows the rate of change. Inflation has slowed down. The other view shows the result. Prices remain high.

Biden’s problem being that while inflation has cooled, the higher prices it caused have not gone away. A cart of groceries that cost $100 to purchase in 2019 and 2020 costs $128 today. It’s the same data but looked at in different ways. One view shows the rate of change. Inflation has slowed down. The other view shows the result. Prices remain high.

All this got started with panic buying due to the pandemic, which then turned into global supply issues. This on top of unpredictable weather and a variety of other problems. There was the widespread outbreak of bird flu that caused the jump in egg and chicken prices. The increased price of sugar is blamed on unusually dry weather that damaged harvests in India and Thailand. The increase in potato chips is said to be caused by an increase in the cost of sunflower oil.

It doesn’t stop. Here on the eve of Valentine’s Day, the price of chocolates is expected to increase due to the price of cocoa futures being driven up by bad weather in West Africa.

And what goes up doesn’t necessarily come down. The Consumer Price Index data is sprinkled lightly with food prices that declined in 2023. Eggs was the big one. Tomatoes, cheddar cheese, strawberries and pork chops came down modestly. But for the most part, what goes up stays up.

Who knows how much of the cost of soda pop is attributable to the can it comes in, but the large increase in soda prices beginning in 2021 was attributed by Reuters to a run-up in the price of aluminum. Aluminum peaked in April 2022 and has since decreased, but the price of soda remains higher than ever.

The chief financial officer of Coca-Cola Co. has been often quoted from the 2nd-quarter earnings call of 2022 for blaming “other costs, including wages, transportation, media and operating expenses are also increasing and adding incremental pressures.”

(“Media” would include, for instance, the $7 million it will take for Coca-Cola to buy a 30-second spot in today’s Super Bowl. According to CBS, that’s up from $4.5 million in 2019. Hard-pressed consumers will find little solace in knowing some portion of their food dollars is funding the football money machine.)

Inflation is frequently attributed to inflation. The circularity of cause and effect seems nonsensical, but there is something to it. For one, higher costs of ingredients inevitably lead to the higher price of the finished product. For another, suppliers raise their prices because they can. With all the other price increases providing air cover, why not join the fun?

Which is what puts us in this jam. Food prices are coming close to qualifying as common purpose. They certainly amount to common concern. Voters clearly expected some greater response from the government than what they got. In France, for comparison, the Macron Administration has attempted to force the big supermarket chains to resist price increases from their suppliers.

The Biden Administration is stuck on what do. Presidential task forces come and go with regularity. What’s the harm of naming another to delve into food prices? The problem being there is a major downside in seeming to take responsibility for something over which, in our free enterprise system, the federal government has no control.

The administration could, however, gain a little credit by more proactively shining a light on what we’re all experiencing along the grocery aisles. Late in the game as this is, it could authorize the U.S. Bureau of Labor Statistics to augment the Consumer Price Index to spotlight who is raising prices, and more favorably who is rolling them back.

A little exposure might be just enough disincentive to slow down the serial increasers. And it would allow Biden to say in a concrete way, “Hey, we’re doing something.”

As usual very insightful. Thanks